Newsletters

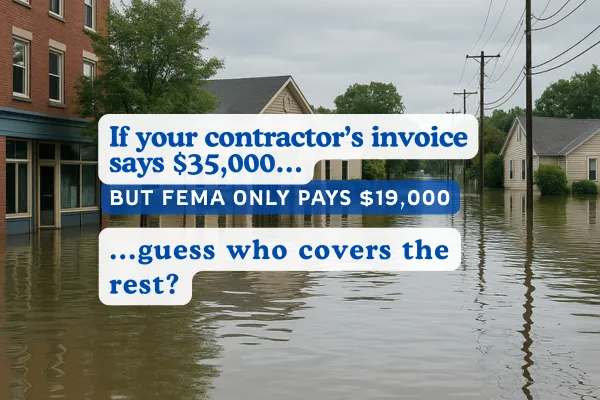

If your contractor’s invoice says $35,000… but FEMA only pays $19,000 — guess who covers the rest?

When a flood hits, one of the first calls property owners make is to a mitigation company or contractor.

They show up, assess the damage, and hand you a detailed estimate for cleanup and repairs.

You breathe a sigh of relief — “At least this will all be covered by my flood insurance.”

But here’s the hard truth:

Just because it’s in the contractor’s estimate doesn’t mean NFIP will pay for it.

And if you don’t understand how NFIP reviews those costs, you could be left holding the bag for thousands — even tens of thousands — in out-of-pocket expenses.

Mitigation and Repair ≠ Automatic Coverage

Contractors are experts at drying, tearing out, and restoring property.

But they are not experts in FEMA’s NFIP policy — and most don’t know what’s actually reimbursable under the flood program.

NFIP follows strict guidelines.

Coverage is based on:

What was damaged by flood (not pre-existing conditions or upgrades)

What’s allowed under the policy form (especially in basements and below-grade areas)

What’s considered “reasonable and necessary” per FEMA’s standards

👉 If the estimate includes non-covered work, upgrades, or inflated labor costs — FEMA won’t pay it.

Real Example: $16,000 Denied Due to Unsupported Labor Rates

A property owner hired a well-known mitigation company after a flood.

The invoice came in at over $35,000 for water extraction, drying equipment, demo, and antimicrobial treatment.

NFIP only approved $19,000 — because:

The labor was billed hourly (NFIP requires line-item pricing, not T&M unless pre-approved)

There was no signed contract

Equipment charges exceeded FEMA’s allowable rates

Non-covered items like carpet removal in a basement were included

The owner was shocked — and stuck paying the $16,000 difference.

Why This Happens

✅ Contractors don’t bill to NFIP standards.

✅ They may include necessary work — but that doesn’t mean it’s covered work.

✅ Most owners don’t know what FEMA allows until after the work is done.

What You Should Do Instead

✅ Get a signed, itemized contract before work begins.

Make sure it clearly separates flood-related damage from unrelated upgrades or maintenance.

✅ Ask your adjuster or a flood consultant to review the estimate.

An extra 10 minutes upfront can save you thousands in denied charges later.

✅ Avoid “lump sum” invoices.

FEMA wants detail — equipment types, dates of use, labor by task. Anything vague will get flagged or cut.

✅ Keep everything documented.

Photos before, during, and after mitigation. Equipment logs. Moisture readings. These all help validate the work.

Final Word:

Your contractor may be doing great work — but FEMA isn’t reviewing their craftsmanship.

They’re reviewing the invoice against the policy.

If you don’t know the difference between “what’s on the estimate” and “what’s covered by flood insurance,” you’re the one who ends up paying for it.

💬 Want to avoid costly claim surprises after the work is already done?

👉 Book a free consultation and let’s get you ready for the next potential flood. Click here and book a call.